LaceyLife – September 2023

Children’s Day: Saturday, October 7 | 11 a.m. – 2 p.m. | Huntamer Park

Children’s Day is the perfect way to kick off fall. It’s a Saturday afternoon of family fun featuring a variety of free activities, arts and crafts, and entertainment for children of all ages! Bring your friends AND your appetite. There will be on-site food vendors with a variety of eats and treats for purchase.

If you’re into creepy crawlers, this year’s theme — Bugs and Insects — is sure to be a hit!

Children’s Day, a partnership between the City of Lacey and North Thurston Public Schools, takes place rain or shine!

For more details, visit the Children’s Day webpage. We hope to see you there!

The City invites you to the 2023 Mayor’s Gala, a biennial fundraiser for the Lacey Veterans Services Hub (Hub). The event takes place on Friday, October 20 from 6–9 p.m. at the South Puget Sound Community College Lacey Campus.

The event includes a social hour, buffet dinner, short program, and opportunities to support the Hub. Individual tickets cost $80 or you can purchase a table of 8 for $600. To buy tickets and view available event sponsorships, visit the Mayor’s Gala webpage.

For more information, contact Jenny Bauersfeld at (360) 438-2621 or JBauersf@ci.lacey.wa.us.

Thurston County Emergency Management Council invites the community to their annual Emergency Preparedness Expo. Stop by and learn:

• How to prepare to protect yourself and your loved ones from emergencies.

• How the Community Emergency Response Team, Law Enforcement, and Fire Department protects you.

Enjoy free activities at the Expo for the whole family! Visit their website to learn more.

Save More Money with Our NEW Energy Efficiency Rebates!

The City has teamed up with Puget Sound Energy (PSE) to save Lacey residents even more money on your energy efficiency upgrades.

How does it work? The City will match the PSE rebate for qualifying equipment upgrades completed after August 4, 2023. And, to make it super easy — you only have to apply once with PSE. Get double the rebate with no extra paperwork!

This matching rebate program is funded by a City initiative as part of our Climate Action Plan and applies to most PSE rebates.

To learn more about how you can save money and energy, visit our Energy Rebate webpage.

City Budget Process: Funding, Expenses, and How to Provide Input

The annual budget is one of the most important documents the City produces. It provides information on revenues (how the City collects funds from a variety of sources) and expenditures (how the City plans to use funds during the current year).

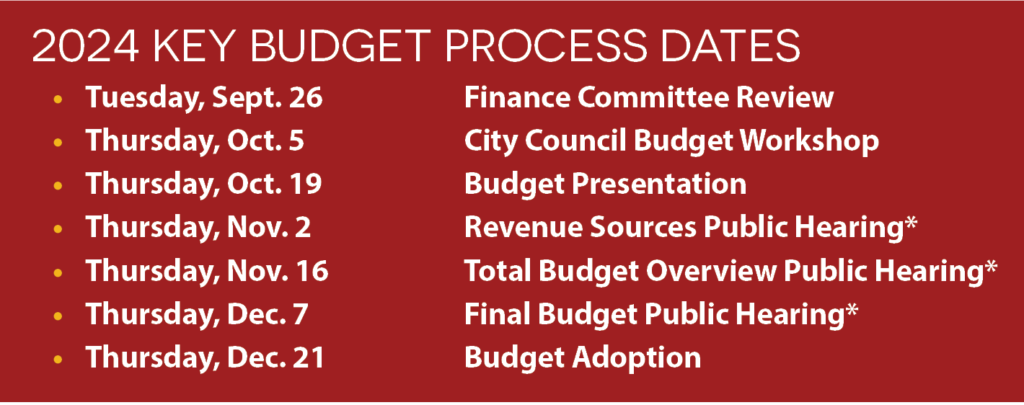

Every year, the budget process begins in July and continues into the fall. As we prepare the City’s annual budget, we invite and encourage public involvement at the public hearings* listed in the 2024 Key Budget Process Dates on the right. Visit the City Council webpage to learn more about public hearings.

How Does the City Get Funding?

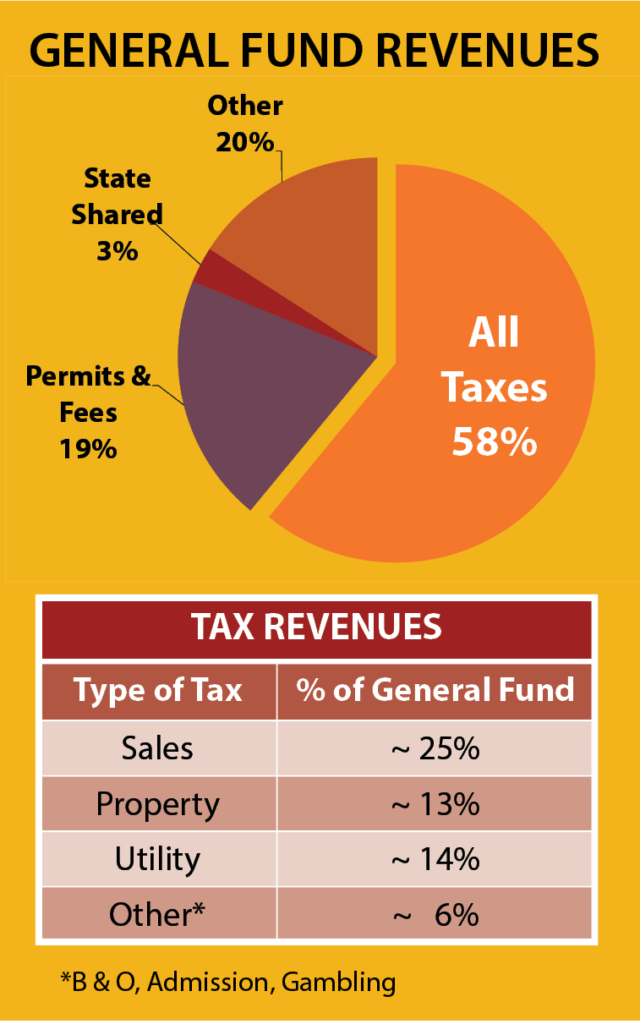

Most City services (police, parks and recreation, finance, planning, administration, etc.) are funded through the “general fund.” The General Fund collects funds from a variety of sources — primarily taxes, like sales and property taxes (see General Fund Revenues table).

The City also has other funds, such as Transportation and Utilities, to name a few.

Sales Tax – Where Does it Go?

Lacey’s current sales tax rate is 9.5% and it is applied to goods, personal and business property, and some services, such as repairs and construction.

Once collected by the State, sales tax gets distributed to several governmental entities, including the City. The City’s portion is 0.85% of the total. This sales tax goes to the General Fund and makes up about 25% of all General Fund revenues.

The City also has a voter approved 0.20% Transportation Benefit District. These funds pay for some of the City’s transportation programs to improve roads and multi-modal transportation options such as sidewalks, bike lanes, etc.

In the example above, for a $100 purchase, the City gets 0.85¢ for the General Fund and 0.20¢ for the Transportation Benefit District of the total $9.50 sales tax collected. The remaining $8.45 goes to the State, Intercity Transit, TCOMM/911, the County, and others.

How Does My Property Tax Get Distributed?

Every year, the property tax levy in Lacey is determined by calculating the 1% allowable limitation and adjusting for the value of new construction, annexations, and refunds.

In 2023, the total property tax rate in Lacey was $9.47 per $1,000 of assessed property value. Of this, only 7.7% (or $0.73 per $1,000 of assessed property value) goes to the City.

The remaining 92% of property tax is distributed between the State, North Thurston Public Schools, Lacey Fire District #3, Medic One, Timberland Library, the County, Port of Olympia, and others.

If a property (home and land) was assessed for $500,000* in 2023, the property taxes would be $4,735.94. Of this total, the City receives $366.13 (see example above). This funding goes into the General Fund to support operations and public services.

*The market value can be higher than the assessed value. See webpage listed below for link to detailed property tax information.

Learn More

You can find several budget and tax resources by visiting our Budget webpage. The Proposed 2024 Budget will also be available on this webpage by Friday, October 20.

View the September LaceyLife in pdf format.